Risk management

Start of main content

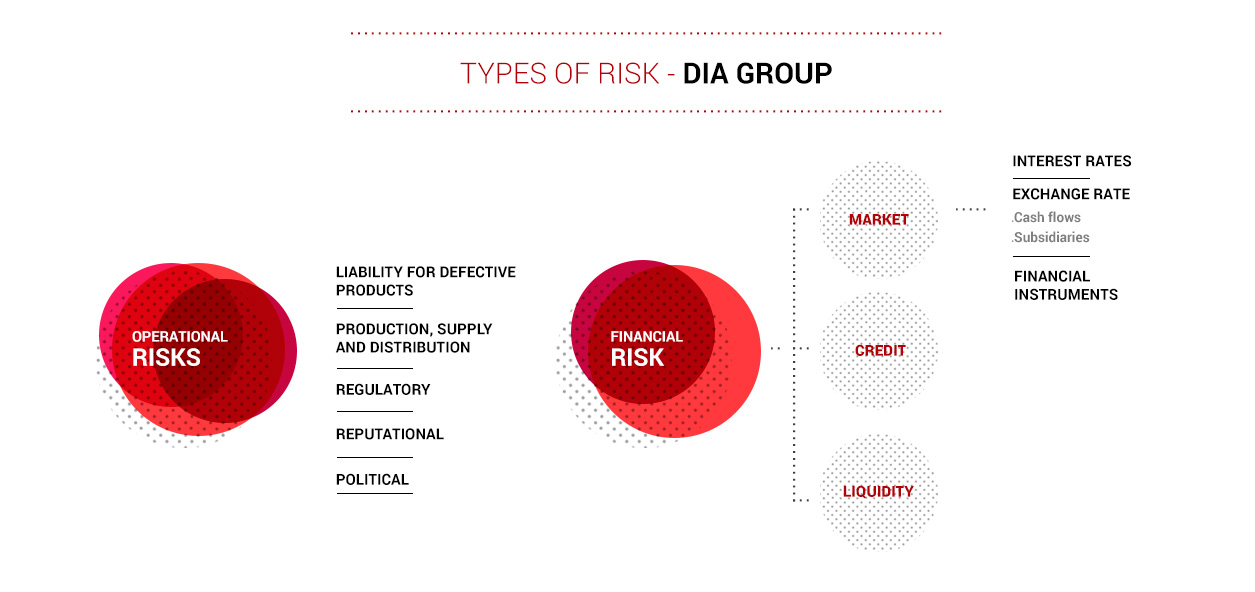

Types of risk

In the DIA Group, each country works on an average of 80 risks, among which around 20 have been identified as key risks for each country.

Operational Risks

Risk of liability for defective products

In order to minimize the risk of placing defective products on the market, the DIA Group guarantees the quality and safety of the products, both of its own-label products and national brands, through an advanced management programme certified under the ISO 9001:2008 standard, which affects all links of the supply chain, from the negotiation and development of each product up to its arrival at the store.

All processes and actions in regard to food quality and safety are described and developed in the corresponding chapters of this report.

With the same objective of mitigating this risk, the company also has an adequate insurance policy in respect of liability coverage for defective products. The quality documents, in turn, establish supplier liability with respect to the safety and legality of the product.

Risks associated with production, supply and distribution

The products marketed by the DIA Group are manufactured or come primarily from the country in which the activity is carried out or from neighbouring countries. This implies a risk in those countries that are more exposed to situations of political and economic instability, acute labour conflicts, and possible contingencies arising from natural disasters.

Given that some of the products distributed are perishables, an inadequate assessment of demand or the inability to preserve the products in stock may complicate stock management and have a negative impact on the Group’s operating results.

Given that some of the products distributed are perishables, an inadequate assessment of demand or the inability to preserve the products in stock may complicate stock management and have a negative impact on the Group’s operating results.

In regard to product distribution, the DIA Group has a series of transport and distribution contracts (activities entrusted entirely to third parties). Any significant interruption in the functioning of the transport network, or the bankruptcy of its suppliers and carriers, may cause delays in the distribution of products and potential shortages in the commercial establishments. Furthermore, failure to comply with tax obligations and Social Security by carriers may imply additional costs regarding possible subsidiary liability in those countries where provided for by law.

If these external suppliers and carriers do not make deliveries or perform their jobs, or experience delays in deliveries or in the performance of their tasks, as well as any extra costs associated with such delays or faults, this could result in additional expenses and a have negative impact on our activities.

The DIA Group has prepared a standard transport contract that it uses for hiring companies to handle the loading, transport and unloading of merchandise, which establishes, among other aspects, the obligation to comply with the internal rules established for the execution of the service both in terms of quality and prevention of occupational risks.

It has also established ongoing control to verify compliance by carriers of their tax and labour obligations, guaranteeing through regular checks that they are up to date in their payments at all times.

The DIA Group has a policy of diversification and distribution of volumes of each platform among a sufficiently large number of companies. Accordingly, a temporary problem affecting one of them can be quickly covered by the rest or by new companies, limiting the impact on the company’s activity.

Regulatory risk

The DIA Group’s business is subject to a broad spectrum of regulations (labour, environmental, fiscal, data protection, retail trade, franchise-related, food handling and safety legislation, etc.) in the different jurisdictions in which it operates. The differences between the applicable regulatory requirements in each jurisdiction may pose a significant challenge in operational terms, by requiring the DIA Group to adapt its business to different regulatory systems.

The DIA Group’s operations can also be affected by regulatory changes applicable to it and, in particular, by regulatory changes affecting opening hours, the construction and opening of new establishments, price setting, and taxes. Any breach of the applicable regulations may result in the imposition of fines, penalties, administrative sanctions, and even potential sanctions of a criminal nature.

The DIA Group’s operations can also be affected by regulatory changes applicable to it and, in particular, by regulatory changes affecting opening hours, the construction and opening of new establishments, price setting, and taxes. Any breach of the applicable regulations may result in the imposition of fines, penalties, administrative sanctions, and even potential sanctions of a criminal nature.

DIA is responsible for identifying, measuring and minimizing the legal risks, continuously monitoring the applicable regulatory framework and informing about compliance with legal obligations to the internal operations managers.

In order to develop and adequately comply with this function, the Group has an organizational structure comprised of a Human Resources Department, a Financial and Fiscal Department, and a Legal Department in all the jurisdictions in which it operates, which have the duty to identify the applicable regulations and supervise their compliance.

To adequately carry out the functions of identification of the regulatory framework and supervision of its compliance, the DIA Group has a regulatory map, which identifies and details all regulations applicable to the Group, with special attention given to key legislation in the main supply chain processes.

To carry out this function, the managers have established a procedure for the monitoring and updating of regulations and communication, which defines the necessary resources, responsibilities and internal and external tools to perform this duty and achieve the twofold objective of having an updated regulatory map and an organization aware of its legal obligations.

Likewise, the DIA Group has policies and procedures aimed at informing and training employees on certain behaviour principles and preventing and detecting inappropriate conducts. In this respect, it is important to mention the existence of the DIA Group’s Code of Ethics and an Ethical and Information Consultation Channel, as well as the implementation of a crime prevention model in the Company.

Reputational Risk

The company faces reputational risks due to its public exposure. All impacts arising from such exposure are monitored and analysed on a regular basis. To minimize risks, the DIA Group has external communication rules and an External Relations Policy.

In 2016, a small group of ex-franchisees repeatedly visited different media to slander DIA. The effect of the appearances in the media or social networks could have a negative impact, although very limited, due to the small number of people and lack of legal backing in regard to their information.

DIA works to continuously improve its franchise network and, in the course of 2016, has noted a positive trend in its annual franchise survey, as well as the commercial evolution of the network. The company has also worked to make society aware of the work and dedication of its more than 3,500 franchises in the countries in wich it is present.

Political risks

The company has risks associated with the political management of market issues and interpretation of laws, as well as the corresponding risks that could arise due to delays or inconsistency with European regulations. These risks could result in negative reputational impacts or have an impact on its operational management.

In 2016, reactions of a political nature occurred in Spain in regard to DIA’s commercial operations, which sought to benefit the consumer and were associated by the political environment with selling at a loss. This relationship could have caused reputational damage in spite of commercial success.

During 2016, the National Commission for Markets and Competition (CNMC) decided to take no further action in relation to the complaint submitted by the FIAB and PROMARCA against the cooperation agreement of Eroski and DIA signed in 2015. However, only one day after the communication of the dismissal of this case, the Agency for Food Information and Control (AICA) notified the opening of disciplinary action for both companies due to alleged infringements of the Law on Measures to Improve the Operation of the Food Supply Chain, linked to the implementation of said agreement.

At the close of 2016, this situation was pending resolution.

Financial risks

Financial risk management is controlled by the Group’s Financial Management. This management identifies, evaluates, and covers financial risks in close collaboration with the business units.

Market risk

A- Interest rate risk

The Group’s interest rate risk arises from fluctuations in interest rates that affect the financial costs of long-term debt issued at variable rates.

The Group carries out various interest rate hedging operations to mitigate its exposure in accordance with its Risk Management Policy. At 31 December 2016 and 2015, there were no outstanding derivatives with external counterparts to cover the risk of long-term interest rate financing.

During 2016, the average percentage of hedges against the level of gross debt was 78.70%, compared to hedges of 80.32% in the previous year.

Elsewhere, the group’s policy regarding financial assets is to maintain their liquidity, making them available for use. These balances are held in financial institutions with the highest credit ratings.

Exchange rate risk

Operational: cash flows

Currency fluctuations, other than those of the local currency, can have a positive or negative impact on the consolidated accounts. The Group strives to minimize the risk through the negotiation of forward currency exchange contracts managed by the Group’s Treasury Department. The sum of the hedging operations carried out in financial year 2016 was USD6.552m and USD5.359m in 2015. This amount represents 66.09% of the operations carried out in this currency in 2016 (98.38% in 2015). At the close of financial year 2016, current hedges in dollars reached USD1.803m (USD1.284m in 2015), with maturities in the next eleven months. These operations are not significant with respect to the Group’s total purchasing volume.

Subsidiaries

DIA has various investments in foreign businesses, whose net assets are exposed to foreign exchange rate risk. Exchange rate risk on the net assets of the Group’s foreign operations in Argentine Pesos, Chinese Yuan and Brazilian Reals are mainly managed through external resources denominated in the corresponding foreign currencies.

The exchange differences included in other comprehensive income are significant, due to the strong devaluations of the Argentine Peso and the Brazilian Real. The variation that would have occurred in the exchange differences, if the exchange rates of Group countries that use a currency other than the euro were to depreciate/appreciate by 10%, would have been +32.71% / -32.71%, respectively, in the net equity of the DIA Group.

Financial instrument risk

The Parent Company has “Equity Swap” contracts for an amount of EUR39.944m. At the close of 2015, this amount reached EUR42.266m. These operations are carried out to comply with the payment obligations resulting from the Long-Term Incentive Plan (LTIP) of the Group’s Directors. They are described in note 16 of the report on the Consolidated Annual Accounts.

Credit risk

The Group does not have a significand credit risk. Active risk policies are maintained to ensure that wholesale selling is made to clients with verified credit solvency. Retail sales imply a lesser risk, since payment is made in cash or by card.

Cash and derivative transactions are made with Financial Institutions with high-quality credit ratings, with a minimum applicable rating of BBB. In countries where the rating is below that rating, it operates with local financial entities that are considered high credit quality by local standards.

In addition, cash surpluses are placed in high quality assets with maximum liquidity. The policy set by the Group’s Corporate Executive Management is based on criteria of liquidity, solvency and diversification, establishing maximum amounts to invest by counterparty, within a maximum term of 90 days of investment duration and definition of the instruments for which the placement of surpluses is authorized.

The Group does not have a significant concentration of credit risk.

Liquidity risk

The Group applies a prudent liquidity risk management policy, ensuring compliance with payment commitments, both commercial and financial, for a minimum period of 12 months; covering financing needs through recurring cash flow generation of its businesses, as well as contracting long-term loans and financing facilities.

At 31 December 2016, liquid assets reached EUR1.258.1bn, including cash and other liquid assets and available credit lines.

- Description of Risk system

- Types of risk

End of main content

- Go up

- Download